Don't Worry Brokers: Insurtech Will Make Your Job More Human

Increased efficiency will free brokers up to do what they do best: support their clients. Let's face it – the past year has brought significant...

Insurance is an industry whose true strength, resilience, and responsiveness is revealed at the worst of times. The industry met the challenges of 2020 with flying colors.

The year also revealed the necessity for digital transformation and the opportunity for those who embrace it.

Read on to learn more about the top trends emerging from 2020 and what you can do in 2021 to seize the opportunities that await innovators.

This past year only accelerated the shift towards digital in every industry. Businesses that have been quick to adapt to the new COVID landscape have thrived and edged out slower competitors. Digital interactions are here to stay and customers expect more in their buying experience. Investing in digital transformation is no longer optional -- it’s table stakes.

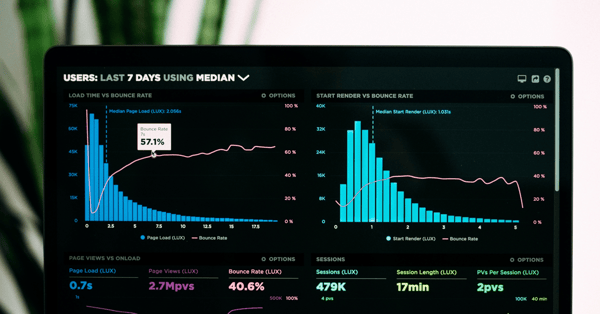

Enhanced digital experiences have a nice side benefit: valuable data. The “internet of behaviors” describes the value that can be realized from data gathered from newly digital experiences. Data gathered through digital interactions can be measured and analyzed in ways that in-person experiences cannot. This creates new opportunities to innovate, improve customer experience, and drive growth.

Innovation opportunities:

How to play it:

Customers have come to expect highly personalized service from agents who understand their needs, interact efficiently, and use every interaction to add value. According to a report by Mckinsey, customers are reporting significantly more efficient meetings with insurers as things have moved digital- 69% of survey respondents reported more efficient interactions.

The demand for more empathetic and efficient interactions is driving new opportunities.

One of the best “low hanging fruit” opportunities is improving how routine customer check ins are conducted. As customer interactions are being re-designed, nudging (regular client touch points with thoughtful prompts and questions) is becoming a proven way to help clients make better decisions, improve product, and increase sales, according to McKinsey.

Innovation opportunities:

Building in more digital touch points can unlock value in four areas:

New technologies and methodologies are emerging to improve the ability of teams to work remotely- beyond just zoom and slack etc. These technologies will help bridge the gap between remote and in person collaboration- affecting internal operations, not just client interactions.

This presents opportunities for organizations to increase efficiencies and unlock value, potentially even beyond pre-pandemic levels. The increase in remote work also presents substantial cyber security challenges.

Just a month into lockdown, the FBI reported a 400% increase in cyber attacks and the recent Solar Winds attack marks a new era in cyber espionage by nation-states targeting the private sector.

With such a huge increase in cyber crime, including a substantial jump in nation-state sponsored attacks, cyber governance will become a priority in 2021, especially as penalties are introduced for companies lacking sufficient cybersecurity infrastructure.

Despite the headlines, the benefits of operating in the cloud far outweigh the drawbacks, and cyber security can be effectively managed with the right tools and practices in place. Outdated software and workflows are not equipped to handle the new frontier of data security.

One emerging technology that will help remedy the issue is called cybersecurity mesh. Instead of a single firewall or gateway to access a software, cybersecurity mesh focuses on checking a user’s identity as they use a software, rather than just when they enter it. Think of it like a bartender checking IDs for every purchase, rather than just having a bouncer.

In addition to the need to innovate, the increased risk of cyber attacks presents an opportunity for brokers and agents to help clients understand how they can lower cyber insurance premiums and guide them towards resources that can help with assessment, governance, and strategy.

Despite the challenges of this past year, insurance is uniquely positioned to capitalize on these changes. As an industry based on data and relationships, the opportunity to help our clients understand and mitigate risks can not be overstated. The firms who innovate now will not only see growth, but will help our clients and the broader economy evolve and adapt to the challenges of tomorrow.

Want to learn more about how Highwing can help you capitalize on these opportunities? We'd love to chat. Get in touch for a free data assessment here.

Increased efficiency will free brokers up to do what they do best: support their clients. Let's face it – the past year has brought significant...

Insurance runs on data. Accurate data is essential to understanding risk, accurately pricing policies, and providing services to complement...

Insurance brokers face a multitude of challenges in today's fast-paced industry. From increasing the company’s profitability and understanding market...